Individual Taxpayer Identification Number

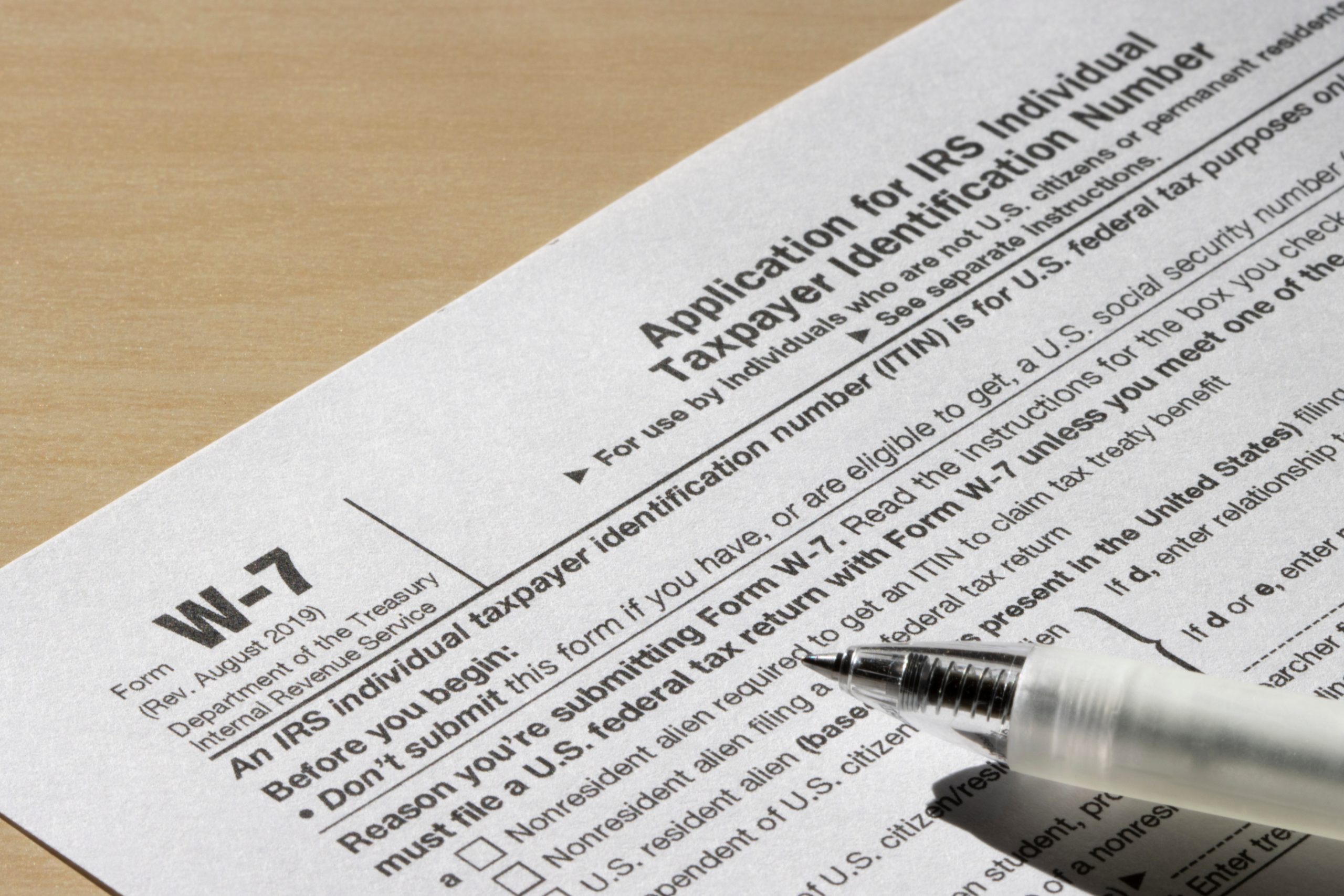

If you’re a non-US resident looking to file taxes, an ITIN is essential. Syntax Solutions will streamline the process, from filling out the W7 form to collecting necessary paperwork and guiding you through approval.

What is an ITIN?

The Internal Revenue Service (IRS) issues an ITIN or Individual Taxpayer Identification number, a nine-digit code. This number is given to people who must pay taxes in the United States but do not qualify for a Social Security Number.

What are the Benefits of ITIN?

Your ITIN isn't just for filing taxes; it enables you to receive income tax refunds from the IRS if you qualify. Additionally, having an ITIN allows you to file taxes and claim benefits for qualifying dependents. It may open doors for activities like opening a bank account or applying for a mortgage loan.

Do I Need an ITIN?

If you qualify for any of the following points, you need an ITIN:

01

Non-US Residents with U.S. Income

If you're earning income from the U.S. but reside elsewhere, securing an ITIN is essential for complying with U.S. tax requirements.

02

Temporary Visa Holders and Spouses

If you're in the U.S. on a temporary visa, such as an L-1 intracompany transfer visa, and your spouse accompanies you, both will need an ITIN to file a joint resident return.

03

U.S. Resident Without an SSN

If you're considered a U.S. resident based on the days of presence test and don't qualify for a Social Security number, securing an ITIN is crucial to fulfilling U.S. tax reporting requirements.

04

Business Investment and Transactions

If you're investing in U.S. businesses or real estate or engaging in business transactions that require tax reporting in the U.S, you must secure an ITIN.