Start your US Business Anywhere, and will be 100% compliant

Start your US Business Anywhere, and will be 100% compliant

LLC Formation, EIN, Registered Agent, Operating Agreement, Annual State Filing and Federal Tax Filing. Syntax Solutions can help you grow your business by handling your compliance requirements.

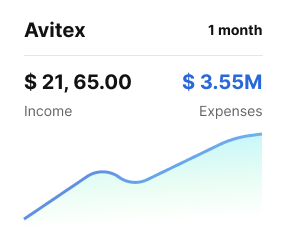

Simplify your Finances. Strengthen your Business

US Business Formation, Operating Agreements and Bylaws, Financial Analysis and Reporting, Tax Return Preparation and Filing, Budgeting and Forecasting. Syntax Solutions can help your business grow and stay compliant.

Simplify your Finances. Strengthen your Business

US Business Formation, Operating Agreements and Bylaws, Financial Analysis and Reporting, Tax Return Preparation and Filing, Budgeting and Forecasting. Syntax Solutions can help your business grow and stay compliant.

Syntax Solutions Best Business Formation and Accounting Services Provider

When starting a new business, having a clear and accurate financial picture from day one is essential. That’s where Syntax Solutions stands out. We help you lay the groundwork for sound financial management, offering accurate recordkeeping, detailed financial statements, and insights that support smarter decision-making.

Since 2021, Syntax Solutions has been assisting entrepreneurs build strong, compliant businesses. Our comprehensive services include:

Financial Statement Preparation

Tax Preparation & Filing

USA Business Formation Services

5M

Trusted by 500+ Customer

around the globe

Syntax Solutions - Your Partner for Smooth Tax Preparation & Filing

Syntax Solutions uses the latest tools to complete all the paperwork required by state agencies and the IRS. We ensure accurate, timely submissions to help maximize deductions. We stay up to date with the latest IRS regulations, so you can have a stress-free tax season.

Our Services

Employer Identification Number (EIN)

Employer Identification Number One of the most important things to consider when starting a business is obtaining an EIN number. Syntax Solutions will seamlessly navigate through your EIN

Accounts Receivable & Payable Management

Accounts Receivable & Payable Management Efficient cash flow is the backbone of a successful business. Whether you’re a small business or a large-scale corporation, Syntax Solutions offers comprehensive

Financial Analysis and Reporting

Financial Analysis and Reporting Numbers tell a story—if you know how to read them. By analyzing financial data, you can derive actionable insights and make smarter business decisions.

Accounting Software Setup and Support

Accounting Software Setup and Support The right accounting software can save you time, reduce errors, and give you real-time insights into your business finances. But setting it up

Budgeting and Forecasting

Financial budgeting and forecasting lie at the heart of every business. From creating short-term goals to allocating resources, they cover everything. However, creating an effective budgeting and forecasting

Business Tax Return Preparation and Filing

Business Tax Return Preparation and Filing Tax season doesn’t have to be stressful—at least not when you’ve got the right team on your side. At Syntax Solutions, we

Individual and Self-Employed Tax Filing

Individual and Self-Employed Tax Filing Tax season can be overwhelming, especially if you’re filing as a freelancer, contractor, or sole proprietor. From managing income from multiple sources to

Annual Report and Compliance Filings

Annual Report and Compliance Filings Ensuring your business stays compliant with state and federal regulations is crucial for its continued success. At Syntax Solutions, we handle your Annual

Electronic Filing (E-filing) Tax Returns to IRS

Electronic Filing (E-filing) Tax Returns to IRS Did you know more than 70% of American taxpayers now file their income tax returns electronically rather than mailing the forms?

Preparation and Filing of Formation Documents

Preparation and Filing of Formation Documents Starting a business in the United States can exciting opportunities for growth, but navigating the filing process can be challenging. Without proper

Banking Resolution Documents

Banking Resolution Documents When setting up a business, most owners focus on registration, licenses, and opening accounts. But an important document often goes unnoticed: the banking resolution. Without

Operating Agreements and Bylaws

Operating Agreements and Bylaws Behind every successful business is a clear structure—and that structure starts with solid, well-drafted documents like operating agreements and bylaws. These essential agreements define

Payroll Management

Payroll Management Payroll is the heartbeat of any successful business. It's more than just cutting checks—it's about accuracy, compliance, and ensuring your team feels valued. At Syntax Solutions,

Our Services

USA LLC Business Registration

USA LLC Business Registration LLC registration in the USA is vital for your business success and doesn't have to be overwhelming. Syntax Solutions will handle all your LLC

Individual Taxpayer Identification Number (ITIN)

Individual Taxpayer Identification Number If you’re a non-US resident looking to file taxes, an ITIN is essential. Syntax Solutions will streamline the process, from filling out the W7

IRS Personal & Business Tax Return Filing

IRS Personal & Business Tax Return Filing Filing your tax returns is crucial for individuals and businesses. Syntax Solutions is here to simplify your personal and business tax

State Annual Report Filing

State Annual Report Filing Have you filed the State Annual Report for your business? If not, keep reading to discover why it matters and how Syntax Solutions can

USA Business Bank Account

Business Bank Account Every year, thousands of people start their businesses in the USA. Establishing a business bank account is one of the most essential steps for laying

Amazon Liability Insurance

Amazon Liability Insurance Ever wondered if Amazon protects you from unforeseen challenges such as liability claims or product-related issues? The reality is, that Amazon doesn't provide comprehensive coverage

USA Trademark Registration

USA Trademark Registration USA trademark registration is crucial for businesses looking to protect their brand identity. Syntax Solutions can handle all aspects of your trademark registration process. What

Setup Amazon Seller Account

How to Set Up An Amazon Seller Account Looking to Expand Your Business? In the dynamic world of e-commerce, tapping into platforms like Amazon can be a game-changer

USA Payment Gateways

USA Payment Gateways Online transactions have become more crucial than ever. Whether you're a small startup or a well-established enterprise, the ability to accept payments online can significantly

Syntax Solutions - Your Partner for Smooth Business Formation and Financial Management

- About Us

- Mission

- Vision

Since 2021, Syntax Solutions has been dedicated to helping entrepreneurs across the US build strong, successful businesses. We provide end-to-end support—from business formation and compliance to accounting, tax preparation, bookkeeping, and financial strategy.

We aim to empower entrepreneurs by offering affordable, professional services for accounting and financial management. With expert guidance and a client-first approach, we help you focus on growth while we handle the details.

Syntax Solutions’ vision is to be the leading resource for business formation and financial services. By delivering exceptional customer experiences and using innovative technology, we envision helping tens of thousands of businesses seek financial compliance every year.

Our Pricing

Choose a plan that’s right for you

- LLC Articles of Organization

- Registered Agent Services

- EIN & Operating Agreement

- Business Bank Account

- X

- X

- X

- X

- X

- LLC Articles of Organization

- Registered Agent Services

- Unique Business Mailing Address

- EIN & Operating Agreement

- Resale Certificate

- Business Bank Account

- Stripe Account

- X

- X

- LLC Articles of Organization

- Registered Agent Services

- Unique Business Mailing Address

- EIN & Operating Agreement

- Resale Certificate

- Business Bank Account

- Professional Amazon Seller Account

- Free E-Commerce Website Development

- Annual Tax Filing Reminders

Reviews

Recommended!!!!

"Used their services and highly satisfied. They helped me in company formation, getting EIN and all kind of certificates needed for online sales. Now, they are working on my taxes. Highly recommend!!!"Highly recommend

"i was newly amazon seller and i hired them For creating LLC in USA and other Certificates they handled it Very professionally.. 100% trusted company.. you will get your work done on time..."I am very happy to have them work

"I am very happy to have them work, their commitment is very good and they have done a great job. i'm highly recommend keep with doing it @syntaxsolutionz."We are very satisfied with that company…

"We are very satisfied with that company for all company matters. That company have active responses and in depth knowledge of registration and after registration matters. Nice services"Don't waste time trying to DIY your LLC - the experts at Syntax Solutions are standing by to help.

Fill out our form with your basic details so our team can reach out to discuss your needs.

Our Blogs

Why IRS E-File Is Important? 7 Key Benefits You Shouldn’t Ignore

How Accurate Bookkeeping Can Transform Your Business Finances?

What is the Difference Between Cash Basis and Accrual Basis Accounting?

Ready to make your business dreams a reality?

Frequently Asked Questions

One of the primary benefits of forming an LLC is limited liability protection. This means that the owners of the LLC are not personally liable for the debts or legal issues of the business. Their personal assets, such as their home or savings, are protected from the company’s liabilities.

Wyoming, Florida, Texas and Delaware, among other states such as Nevada, have built a reputation among business owners for offering special tax benefits if you register as a Foreign LLC there.

Every foreign corporation that is engaged in trade or business in the United States at any time during the tax year or that has income from United States sources must file a return on Form 1120-F, U.S. Income Tax Return of a Foreign Corporation.

Tax ID number and EIN (Employer Identification Number) are often used interchangeably, but there is a slight difference between the two.

A Tax ID number is a unique identification number that is assigned to a business entity by the IRS for tax purposes. It is also known as an Employer Tax ID, and it can be used for both federal and state taxes.

Frequently Asked Questions

Bookkeeping is the process of recording and organizing a company's financial transactions. Accounting involves a higher-level analysis of this data, including financial reporting, tax planning, and strategic financial advice. Our services often integrate both to provide a holistic financial solution for your business.

Yes, we can assist with tax preparation by ensuring your books are accurate and ready for tax season. We work with your tax professional to provide the necessary reports and documentation. In some cases, we may offer tax filing services directly.

Outsourcing to us allows you to focus on what you do best: running your business. We provide expert financial management, ensure compliance, save you time, and give you clear financial insights to make better business decisions, all at a lower cost than hiring a full-time employee.

They are crucial for several reasons: they help you make informed business decisions, track your company's performance, secure funding or loans, attract investors, and comply with tax and regulatory requirements.

GAAP (Generally Accepted Accounting Principles) is the set of accounting standards used in the United States, while IFRS (International Financial Reporting Standards) is used in many other countries. We can prepare your financial statements according to the standards required for your specific business.

An LLC (Limited Liability Company) is a flexible business structure that provides liability protection to its owners (called "members"). It's a popular choice for small businesses due to its simplified management and pass-through taxation.

A Corporation (C-Corp or S-Corp) is a separate legal entity from its owners ("shareholders") and is more complex to manage, but it can be beneficial for businesses that plan to raise capital through selling stock. We can help you understand which structure is right for your goals.

An EIN (Employer Identification Number) is a unique nine-digit tax ID assigned by the IRS. You will need an EIN to open a business bank account, hire employees, and file federal tax returns. We can apply for an EIN on your behalf as part of our service.